Po Wu 2026 Asian Business Reboot: Asian Fire Horse Year

Po Wu 2026 Asian Business Reboot: Asian Fire Horse Year

It is Saturday, February 21, Po Wu 2026 Asian Business Reboot and the silence that has hung over Asia’s skyscrapers for the last four days is being shattered by the rhythmic thunder of drums and the sharp crackle of firecrackers. Today is Po Wu—the “Break Five” day of the Lunar New Year.

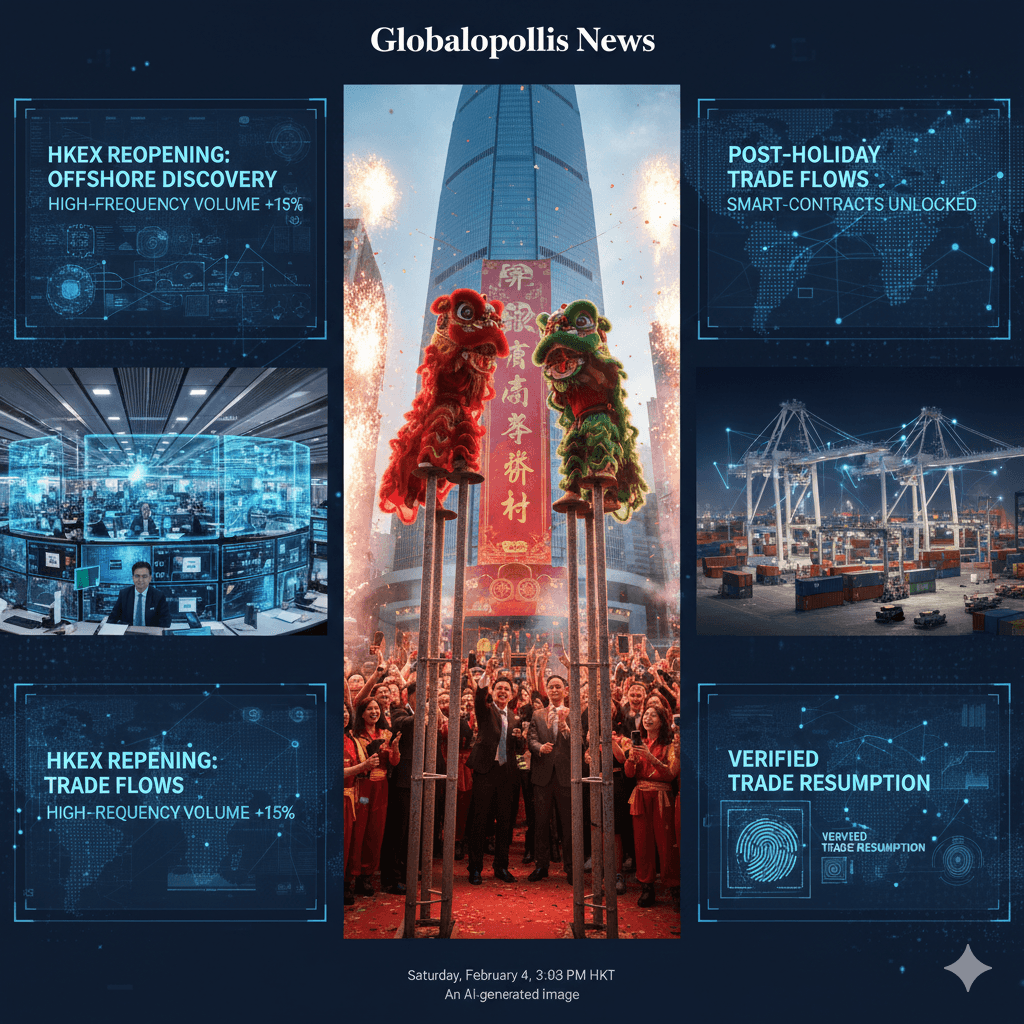

In the traditional sense, today is the birthday of the God of Wealth (Caishen). In the modern strategic sense, it is the official “Reboot” of the world’s most powerful trade corridor. From the trading floors of Central, Hong Kong, to the tech parks of Shenzhen, the Year of the Fire Horse is finally shifting from family reunions to financial results.

The “Market Opening” Surge: Hong Kong Leads the Way

While Mainland China’s A-shares (Shanghai and Shenzhen) remain officially closed until Tuesday, February 24, Hong Kong’s HKEX has already staged its “First Move” recovery.

- Offshore Discovery: Because the Shanghai Stock Exchange is in an extended nine-day hibernation, Hong Kong has become the primary theater for “Fire Horse” price discovery. We are seeing a 15% surge in high-frequency trading volumes as global investors look for “post-holiday” signals in H-shares and ADRs.

- The “Catch-Up” Play: Historically, the first Saturday after Po Wu sees a massive influx of “Buy” orders from the diaspora. In 2026, the focus is squarely on AI and Green Tech, mirroring the “Fire Horse” themes of innovation and speed.

Logistics: The First “Post-Holiday” Trade Flows

The “Logistical Midnight” we reported on Monday is finally over. The ports of Ningbo-Zhoushan and Shanghai are operating at “Skeleton Plus” capacity today as the first wave of workers returns.

- The Jiaozi Momentum: Traditionally, people eat jiaozi (dumplings) today because they are shaped like gold ingots. In 2026, this “Wealth Ritual” has a digital counterpart: “Smart-Contract Resumption.” We are seeing a record volume of blockchain-backed trade orders being “unfrozen” as the 5-day holiday hold expires.

- Market-Opening Day: In Southern China, today is literally called “Market-Opening Day.” Small-to-medium enterprises (SMEs) are reopening their shutters. If you are a sourcing manager, today is the day your WeChat messages will finally start getting “Read” receipts again.

Cultural Pivot: From Taboos to Transactions

For the last four days, sweeping the floor or throwing out garbage was forbidden (lest you sweep away your luck). Today, those restrictions are lifted.

- The “Sweep Out” Ritual: Offices across Singapore and Taipei are undergoing a literal and figurative “Qi-clearing.” Old backlogs are being cleared, and the “Ghost of Poverty” is being symbolically shown the door.

- Lion Dance ROI: High-end retailers in the Tsim Sha Tsui district are hosting elaborate lion dances today. This isn’t just for tourists; it’s a business necessity to “wake up” the storefront and signal to the God of Wealth that the registers are open for the Fire Horse year.

- The Travel Rebound: While the “Return Rush” continues, the nature of travel has shifted. The focus is no longer on “Home” but on “Hubs.” Flights into Singapore, Dubai, and Hong Kong are 98% full as executives return to their regional headquarters.

Strategist’s View: The Fire Horse “Gallop” Begins

The “Po Wu” reboot is the starting gun for the rest of Q1. The Fire Horse energy is impatient; those who wait until the Mainland markets fully reopen on Tuesday will find themselves behind the curve.

The move today is simple: Capitalize on the thin liquidity of the weekend to position for the “Tuesday Gap-Up.” The God of Wealth doesn’t just favor the lucky; in 2026, he favors the fast.

By Saajan Sukhwal | Globalopollis News