Post-Super Bowl LX Travel Exit 2026 & Dubai Invest Pro Summit

Post-Super Bowl LX Travel Exit 2026 & Dubai Invest Pro Summit

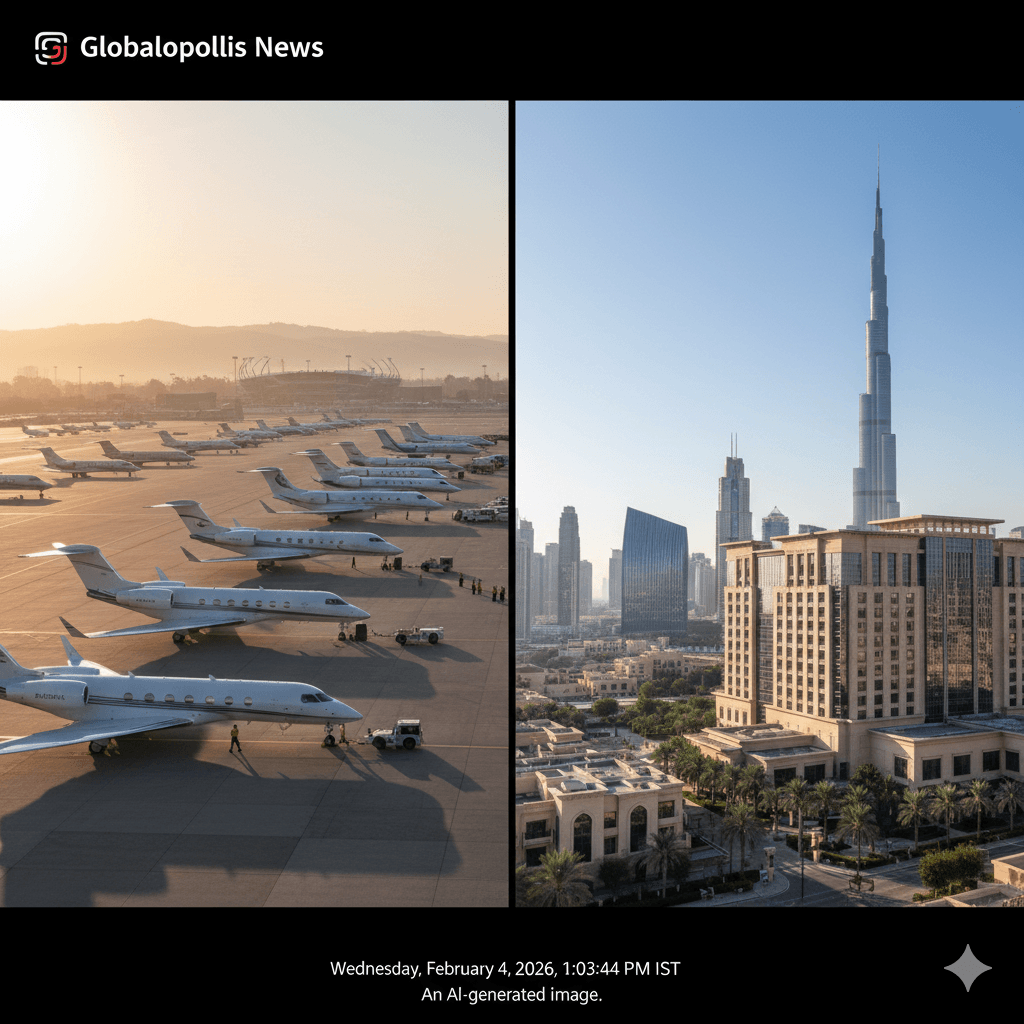

Post-Super Bowl LX Travel Exit 2026: The confetti has barely been cleared from the turf at Levi’s Stadium. But for the global strategist, the real game has just moved to the tarmac. It is 6:00 AM on Monday, February 9, 2026, and the San Francisco Bay Area is currently experiencing the single most complex “exit surge” in its aviation history.

As I watch the first wave of over 1,000 private jets prepare to clear San Jose Mineta International (SJC). My focus is already shifting 8,000 miles east. Today isn’t just about leaving California. It’s about the start of the Invest Pro UAE 2026 summit at the St. Regis Downtown Dubai. Where the future of global wealth migration is being written in real-time.

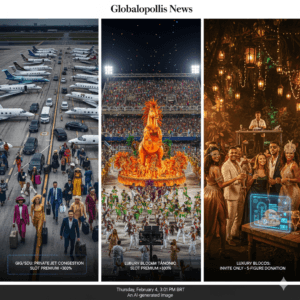

The Great SJC Exodus: 1,000+ Jets on the Move

If you are at SFO or SJC this morning, you are part of a record-breaking 170,000-passenger departure wave. But the real story is on the General Aviation (GA) ramps.

- The PPR Bottleneck: The FAA’s “Prior Permission Required” (PPR) program is in its final, most intense 24-hour window. Every departure slot from SJC, OAK, and even smaller hubs like Palo Alto (PAO) is booked to the minute.

- Extended Tower Hours: For the first time, the SJC control tower has extended its 24-hour operations through tonight to manage the “drop-and-go” backlog.

- Strategist’s Alert: If you are flying commercial, the “Super Bowl Hangover” is real. Security lines at SFO are hitting 50-minute peaks. If you haven’t left for the airport yet, your 3-hour buffer is no longer a suggestion—it’s a requirement.

Pivot to Dubai: The InvestPro 2026 Wealth Summit

While the Bay Area deals with traffic. The St. Regis Downtown Dubai is currently hosting 300+ of the world’s most influential family offices, tax consultants, and investment migration experts.

The InvestPro UAE 2026 conference is the first major B2B summit of the year to address the “Great Wealth Migration.” As borders become more digital (think the UK ETA and ETIAS).Tthe “Citizenship by Investment” (CBI) market is shifting from a luxury to a logistical necessity.

Key Topics from the St. Regis Floor Today:

- The “Fire Horse” Effect: With the Lunar New Year (Year of the Fire Horse) approaching. Asian investors are looking at UAE’s Golden Visa as the ultimate hedge against regional volatility.

- Asset Protection in the Digital Age: Moving wealth is no longer just about wire transfers. It’s about “Bespoke Corporate Frameworks” that bypass traditional banking friction.

- The Greece/Portugal Pivot: Despite rising price floors, European Golden Visas remain the hot-ticket item for delegates looking for a “Plan B” entry into the Schengen zone.

Globalopollis Note: I’ll be tracking the “France Ultra-Luxury” presentation later today—Odiot’s move into the silversmithing investment market is a fascinating look at how HNWIs are diversifying into “tangible heritage” assets.

The Globalopollis Verdict: Mobility is the New Currency

Today’s contrast is stark: the physical gridlock in Santa Clara versus the fluid, digital wealth strategies being discussed in Dubai. The takeaway for 2026? Whether you are navigating a Super Bowl exit or a global tax restructuring, advance reservation is your only leverage. In a world of 1,000-jet surges and 30-country summits, the “last-minute” traveler is the only one who loses.

By Saajan Sukhwal | Globalopollis News